2018 CBK Banking Symposium: Pan-African Banks on The Rise

The Kenya School of Monetary Studies, Nairobi, Kenya

What does the rise of pan-African banks mean for Kenya and other African countries? What do new research findings on these indigenous banks mean for bank managers, private sector practitioners and financial sector regulators?

Joint Conveners:

Central Bank of Kenya (CBK)

Centre for Global Finance,

SOAS University of London

Pan-African banks are on the rise. The rapid expansion of these indigenous banks is so phenomenal that Pan-African banks have succeeded to dislodge some well-entrenched European and American banks, which had been very active in the continent for more than five decades.

A team of 20 CGF researchers from Africa, Europe and North America have been looking into the rise of pan-Africa banks and related issues, as part of a research project funded by DFID and ESRC under the DFID-ESRC Growth Research Programme (DEGRP), ES/N013344/2. Their findings provide the material for this symposium.

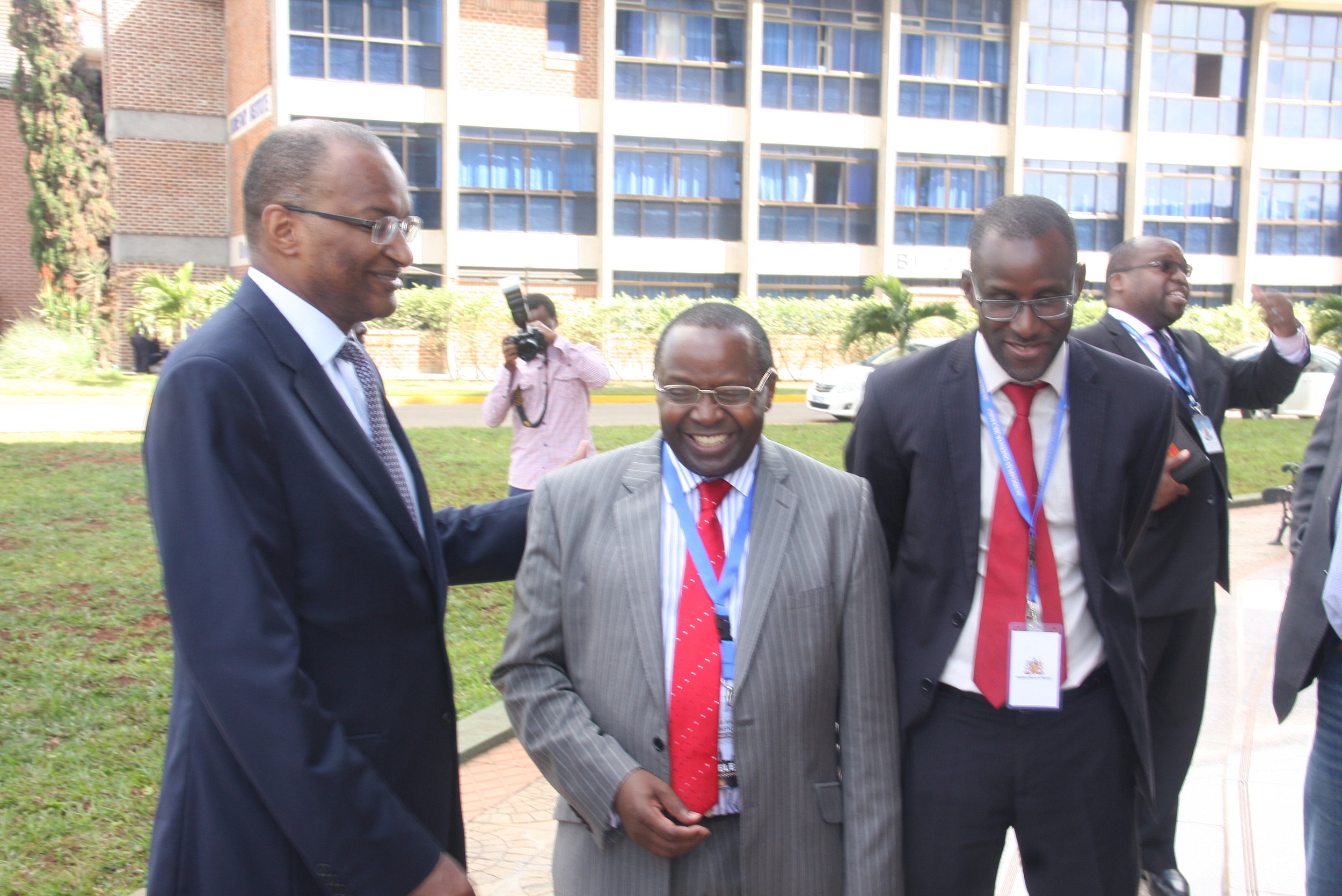

At the official opening speech, Governor Njoroge pointed out that Pan-African banks support the strengthening of trade within the continent, provide mechanisms for capital flows and labour movement in the continent, and help in the transfer of new technologies and skills to domestic banks. He observed that Pan-African banks need to be customer-centric, across Africa:

“Being customer-centric is the way to have a sustainable business model”, commented Dr Njoroge.

The Deputy Governor, Mrs Sheila M'Mbijjewe, highly acknowledged that “the transformation of the banking sector in Africa is happening; we should explore the vast opportunities and find solutions to challenges so that we can take advantages of these opportunities and at the same time address the challenges.”

The Deputy Governor concluded that the CBK looks forward to continuing an active partnership with Professor Murinde and SOAS University of London.

Following the DG’s comment on future collaboration, Mr Raphael Otieno, the Director of Research Department at the CBK, reinforced the need of continuing this joint event and embracing a wider scope of participants across Africa.

Professor Murinde remarked that: “we are very much honoured and grateful to the Central Bank of Kenya for making this event possible. In many ways, the CBK is demonstrating the need for a close collaboration between the researchers that do the theory and generate evidence, and the policy makers that work at the front line of key issues on the daily basis. It is a great opportunity that we can indeed interface with experiences of these policy makers and then invoke, generate or build new theories and test them and see whether the evidence we generate can feed back into policy.”

The symposium also brought together other key stakeholders who have important roles to play in shaping the developments of the financial system, industry, commerce, especially the private in Kenya, in light of the rise of Pan-African banks. These stakeholders include bank managers, banking sector regulators, private sector practitioners and researchers.

In addition, symposium participants also used the opportunity to shape current and future research on Pan-African banks, from the perspective of Kenya. For example, does the rise of Pan-African banks translate into an increase in firms’ access to finance – if not, what should be done, in terms of policy and practice? How do different types of private capital flows affect productivity across the different recipient sectors (agriculture, trade, infrastructure, services, extractives, construction, manufacturing and tourism) in Kenya or in Africa? How do fixed and mobile telecommunications and mobile money contribute to economic growth, human development and financial inclusion in African countries, especially in Kenya? Does microcredit increase hope, aspirations and well-being?